The Bright Outlook for REITs in 2024

Are you interested in what Real Estate Investment Trusts (REITs) could do in 2024? Based on what an expert knows about the market, things look good for REITs in the future. Let’s look at the details and find out why REITs will likely do better next year.

Historical Performance and Current Trends

In the past, REITs have done better at the end of a run of rate hikes, and this time is no different. In the last 40 days, different REIT areas have shown direction changes. In digital real estate, data centers and transportation facilities have clear trends and tailwinds.

Sector Projections

There is a good chance that REITs with industrial and transportation buildings will keep doing well. While the total office market has seen a 40% rise, the focus is on the distinction between quality and non-quality office properties. Based on this information, it looks like some industries could do better in the REIT market.

Resilience in Securing Lending

Despite a freeze in the real estate market, REITs have demonstrated resilience in getting lending. The drop in private mortgage rates may lead to a loosening of demand and lending limits, providing a favorable situation for REITs. Additionally, their reliance on unsecured markets and low-leverage fixed-rate loans has boosted their ability to secure funds

Market Prospects and Future Predictions

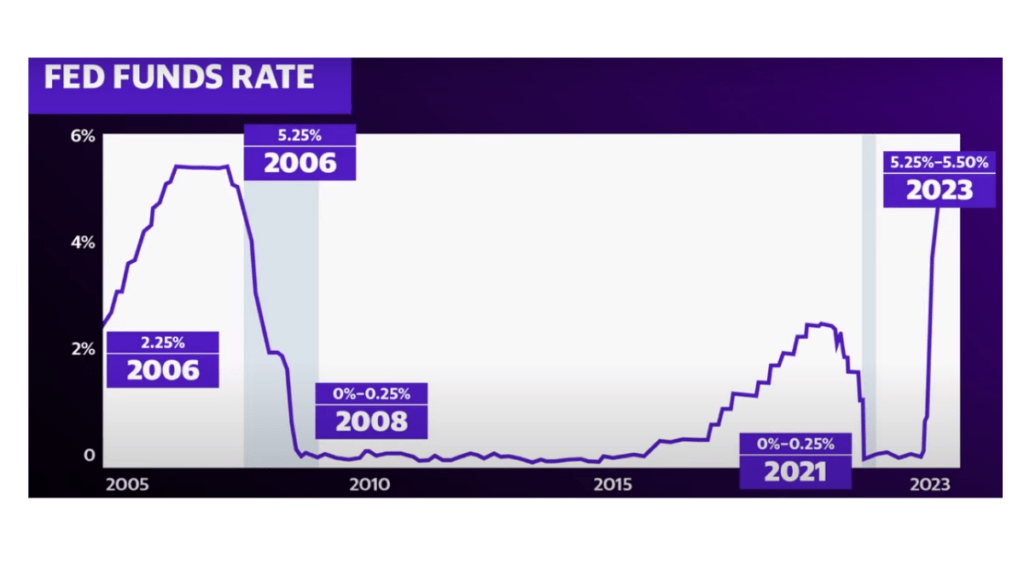

With the predicted easing of the FED to a higher rate environment, the business real estate sales market is forecast to open up in 2024. REITs, as long-term operators and owners of real estate, hold access to capital through both debt and stock, placing them as possible sellers in specific situations.

ESG Integration and Regulatory Influence

The link between REITs and ESG (environmental, social, and governance) investing is becoming increasingly notable. As long-term stewards of real estate, REITs are drawn towards better sustainability measures. Moreover, the focus on regulations and sustainability acts as a driving force behind their great success in 2024.

John Worth at Yahoo Finance

Worth explains the upside for REITs here: “I think that even with the Fed easing, that’s going to be easing to a higher rate situation. So I do think in 2024, we’ll see some of that business real estate sales market open up, and we’ll see some of those prices start to reflect the fact of higher interest rates. I think there’s a good reason for public REITs to be possible winners in that because, again, they’re coming in with low leverage, they have access to capital through both debt and stock and so they can potentially be the buyers in those cases.”.

The positive outlook for REITs in 2024 is boosted by past performance, sector-specific forecasts, resilience in getting loans, bright market prospects, and a focus on sustainability. As the sector changes to the changing financial environment, REITs are set to show strong performance and act as possible drivers of stability amidst market volatility