When we last examined Real Estate Investment Trusts (REITs) in December 2023, investors were cautiously optimistic. The Federal Reserve was signaling that its cycle of aggressive rate hikes was slowing, and analysts expected the real estate sales market to thaw during 2024. That optimism has largely played out, and as we move through 2025, the REIT market is standing on firmer ground. Some sectors are powering ahead, others are stabilizing, while a few are still struggling; however, the broader picture is one of resilience and adaptability.

A Global Perspective: Beyond North America

One of the most significant shifts since 2023 has been the widening performance gap between regions. While U.S. REITs have had a mixed run, markets abroad are showing stronger returns. By mid-2025, Europe and Asia had delivered double-digit gains for REIT investors 24% and 18%, respectively, while North America had barely broken even. This has made diversification more important than ever. Global investors who spread their capital across regions, rather than sticking to U.S. names, have clearly been rewarded.

ALSO READ: Pakistan, China, and Afghanistan Come Together To End Terrorism, TTP, And BLA

Sector Breakdown: Who’s Winning, Who’s Losing

Data Centers: The New Powerhouses

No sector has captured as much attention as data centers. Fueled by artificial intelligence, cloud adoption, and increasing demand for digital infrastructure, these REITs are thriving. Occupancy rates are high, and long-term leases provide predictable income. Despite challenges such as power constraints, many operators are exploring innovative energy solutions, including nuclear partnerships and advanced cooling systems, to meet demand. Simply put, data centers have become the crown jewel of the REIT universe.

Healthcare Aging Populations, Strong Growth

Healthcare-focused REITs have also performed well, capitalising on demographic trends. Senior housing facilities, in particular, are experiencing higher occupancy and improving margins after a post-pandemic slump. The ageing global population is creating steady demand, giving healthcare REITs a reliable growth runway that should extend well beyond 2025.

Industrial & Logistics Still Solid, But Cautious

The warehouses and logistics sector continues to benefit from e-commerce and the evolving needs of global supply chains. However, after years of nonstop expansion, supply is catching up. Vacancy rates are creeping up, though rental growth and strong tenant demand are keeping the fundamentals sound. Investors remain positive about this category, but they are closely monitoring for signs of oversupply.

Office A Market Split in Two

Office REITs remain the biggest question mark. Remote and hybrid work trends have left many lower-tier properties struggling with vacancies and falling values. On the other hand, high-quality “trophy” buildings in prime locations are holding their ground and attracting tenants. The story here is less about offices disappearing and more about a sharp divide between desirable and obsolete assets.

Hotels: Early Signs of a Comeback

Hotel REITs were hit hard in 2023 and 2024, but the picture is starting to improve. Travel demand has resumed, and some operators are reporting double-digit revenue growth. Still, the sector is volatile and more exposed to economic slowdowns than others. Investors with a higher risk tolerance may find opportunities, but stability cannot be guaranteed.

Market Drivers in 2025

Interest Rates and Capital Access

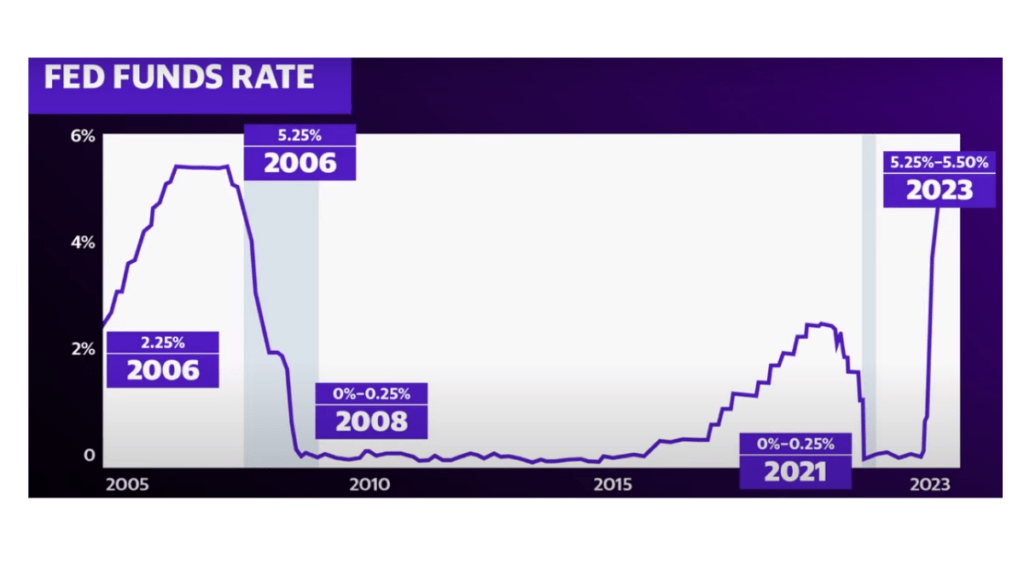

The biggest tailwind for REITs has been the shift in interest rate policy. The Fed is no longer hiking aggressively, and although rates remain higher than pre-2020 levels, the stability has helped unlock lending and deal activity. REITs with strong balance sheets, low leverage, and fixed-rate debt are in the best position to benefit from this trend.

Valuations Still Attractive

Compared to private real estate, public REITs are trading at a discount. That gap has encouraged some investors to rotate into listed REITs, viewing them as a cheaper entry point into high-quality real estate. For buyers with patience, today’s valuations could prove rewarding over the long run.

ESG and Sustainability

Environmental, social, and governance (ESG) considerations are no longer a side note; they’re central to REIT strategies. In India, for example, the Mindspace REIT recently raised funds through sustainability-linked bonds, showing how green financing is reshaping the market. Globally, investors are rewarding companies that integrate sustainability into their portfolios.

Regional Spotlights

India

India’s REIT market is maturing fast. Originally dominated by office space, it is now expanding into malls, logistics, data centers, and even residential areas. Occupancy levels remain high, and global investors are taking notice. India’s REIT sector is increasingly seen as a model for growth in emerging markets.

United Kingdom

In the UK, consolidation is the big story. Smaller trusts are merging or being acquired to build scale and improve liquidity. For investors, this has created opportunities to buy into stronger, more diversified entities at attractive valuations.

Australia

Australian REITs are also adapting, with companies like Stockland moving beyond traditional property into data centres. This diversification reflects the same global trend seen elsewhere: REITs positioning themselves for the digital economy while maintaining steady exposure to residential and logistics assets.

What Analysts Are Saying

- Total Returns: Many analysts expect REITs to generate total returns of around 9 to 10% in 2025, roughly in line with long-term averages.

- Defensive Appeal: In early 2025, REITs outperformed the S&P 500, proving their defensive qualities during market pullbacks.

- Sector favourites include data centres, healthcare, self-storage, and industrial sectors, while offices are still viewed with caution.

- Dividends: Yields are attractive, often ranging between 3% and 7%, making REITs a compelling option for income-focused investors.

Looking Ahead

The REIT market today looks far more balanced than it did in late 2023. Rising interest rates were a major concern back then; now, stability is giving the sector room to breathe. Strong fundamentals in healthcare and data centres, steady industrial demand, and tentative recovery in hotels paint a picture of cautious optimism.

That said, risks remain. Office properties continue to drag on overall sentiment, and global economic uncertainty could slow deal-making. Yet, with valuations still attractive and dividend yields well above those of the broader stock market, REITs remain a practical way for investors to combine income, diversification, and long-term growth.

From December 2023’s cautious predictions to August 2025’s clearer picture, REITs have proven their resilience. The strongest sectors are not just surviving but thriving, driven by digital transformation, demographic shifts, and disciplined financial management. For investors willing to be selective, 2025 presents numerous opportunities in this evolving asset class.

My name is Farhad Dawar and I am graduate of the Institute of Media and Communication Studies Bahaddin Zakariya University Multan Pakistan. I’m passionate about journalism and media, and I believe in journalism of courage, uncovering the truth, and shaping the future.