Nvidia’s earnings figures have become a key test for the market. The growing popularity of artificial intelligence (AI) in the past few years has made Nvidia a major player in the stock market. The company is no longer limited to making graphics chips; it is now essential to the technology that underpins AI. Nvidia chips are in the data centers of every major AI company, and that’s why investors are watching its performance.

Nvidia’s stock has risen 35% this year but has seen some declines in recent weeks due to growing investor concerns about an AI bubble. People are starting to ask whether this AI craze can actually bring such tremendous growth, or if it is just a temporary hype that will soon die down. Palantir’s weak results last month added to that concern, and several AI stocks saw declines.

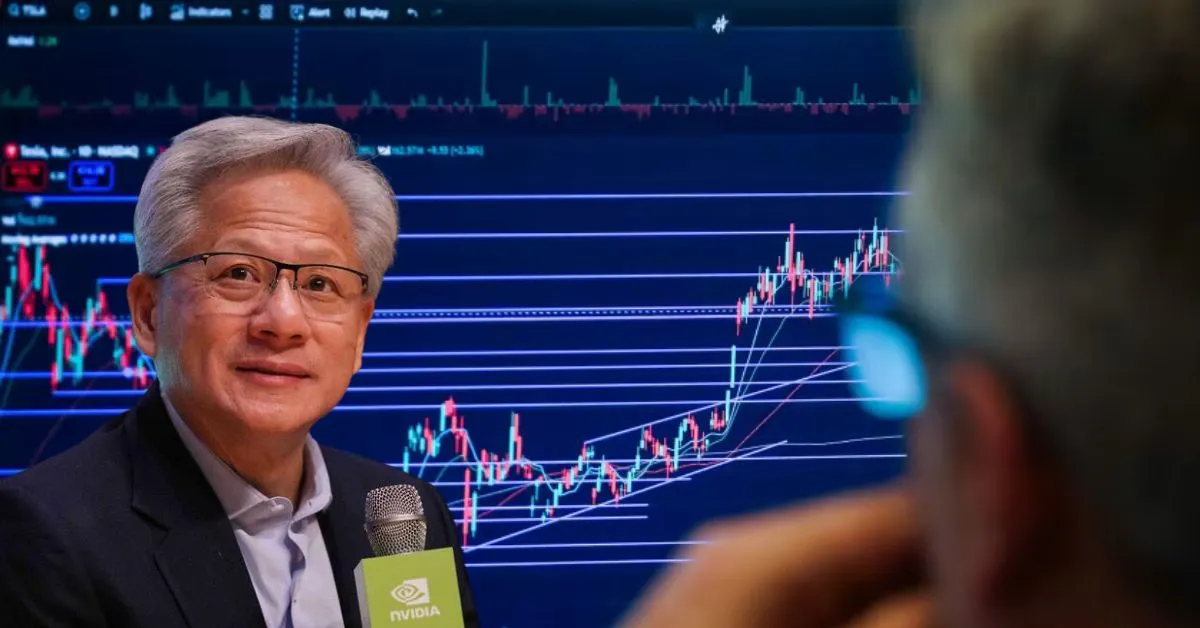

Nvidia CEO Jensen Huang’s statements are also important to investors. The market sees everything he says as an indicator of the AI economy’s strength. If the company fails to meet expectations, it could be a wake-up call for the stock market. Investors are not only watching Nvidia’s earnings but also its prospects and chip demand.

Nvidia’s market value has reached almost $4.4 trillion, which makes it one of the largest companies in the world. This value is smaller than the economies of only the United States, China, and Germany combined. Because of this volume, the company’s performance affects not only AI stocks but also the overall market index.

Investors are also watching whether the growing investment in AI will actually pay off. AI chatbots, such as ChatGPT, and other data centers rely on Nvidia chips. Based on this, Nvidia’s market figures will be used to assess whether this AI craze is turning into real growth or has just become a bubble.

Nvidia’s earnings results are a kind of test. If the company delivers strong results, investor confidence can increase, and AI stocks can rise again. But if the results fall short of expectations, the market can decline, and investors become cautious.

In Short, Nvidia’s recent financial period will give investors a clear signal about the health of not just one company, but the entire AI industry. This is a decision moment for the market, and all eyes are on whether AI will truly become a source of long-term growth or is just a one-time hype.